Warren.finance raises serious concerns for potential investors, as it lacks transparency regarding ownership and key executives on its website. In this article, we delve into the suspicious details surrounding Warren Finance and shed light on the risks associated with its investment schemes.

Before we start, this HYIP is currently Paying..

If you choose to invest it is solely your responsibility and we wish you success

Active since: 2023-11-10

Staking: 2.72%/Daily

Status:

Affiliate program:

-

1. Base Reward Rate: Participants meeting minimum requirements receive a competitive 2.5% base reward, enticing initial involvement and continued support for the protocol.

-

2. TVL – Linked Reward Increase (Total Value Locked):

2.5%

3.5%

4.5%

5.5%

7%

8%

9%

10%

-

3. Dynamic Tier Differential: Rewards are meticulously calculated based on tier differentials among users, fostering a fair distribution system and thwarting any potential manipulation.

-

4. Transparency and Accountability: All facets of the incentive program are made public and easily accessible, fortifying trust and transparency within the system.

-

5. Anti-Manipulation Measures: The program is intricately designed to minimize the risk of abuse or manipulation, guaranteeing an impartial and equitable distribution of rewards.

Dubious Leadership Claims: On its GitBook platform, Warren Finance attributes its success to individuals known as “Moonshot Max,” “Math,” and “Nomad.” Strikingly, only Telegram user accounts are provided as points of contact, raising an immediate red flag for anyone considering involvement.

Moonshot Max and Frauds: Moonshot Max, presenting himself as a US national on his YouTube channel, is associated with fraudulent crypto investment schemes, notably the collapsed and rebooted Drip Network. This history of fraudulent promotions signals a lack of credibility and reliability.

Questionable Website Registration: Warren Finance’s website domain, “warren.finance,” was privately registered on November 10th, 2023. The secretive nature of its registration adds to the suspicion surrounding the legitimacy of the company.

No Real Products, Only Affiliation: One of the glaring issues with Warren Finance is its lack of retailable products or services. Affiliates are solely focused on marketing the Warren Finance affiliate membership, indicating a potential pyramid scheme.

Compensation Plan Red Flags: Warren Finance’s compensation plan promises a 2% daily ROI, capped at 175%. Additional bonuses are offered for specific conditions, such as not withdrawing and making substantial investments. However, the lack of transparency regarding downline investment volume requirements raises concerns about the legitimacy of these claims.

Unusual Unilevel Structure: Unlike typical MLM compensation plans, Warren Finance employs a unilevel compensation structure. This structure calculates referral commissions across five levels, ranging from 2.5% to 10% of DAI invested by personally recruited affiliates. The absence of disclosed downline investment volume requirements adds to the ambiguity surrounding the compensation plan.

Free Membership, Costly Investment: While Warren Finance offers free affiliate membership, participation in the income opportunity requires an investment in DAI. This emphasizes the company’s focus on generating revenue through investments rather than legitimate product sales.

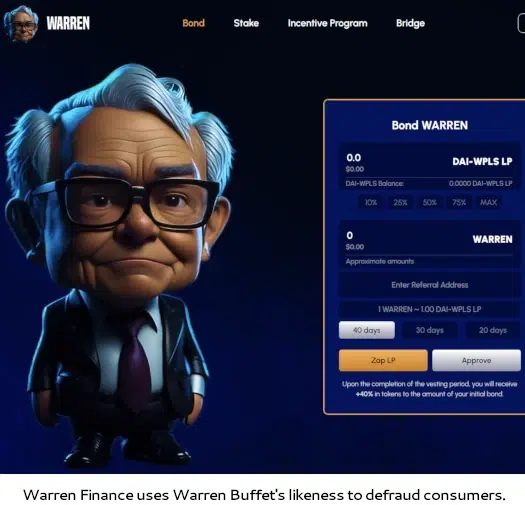

Unauthorized Use of Warren Buffet’s Likeness: Warren Finance’s marketing tactics involve the unauthorized use of Warren Buffet’s likeness, resembling crypto scams that exploit well-known personalities for promotion. This raises ethical concerns and questions the legitimacy of the company’s practices.

Regulatory and Legal Issues: Warren Finance is implicated in securities fraud, wire fraud, and money laundering. With “Moonshot Max” potentially being a US national, the company falls under the jurisdiction of the SEC. However, a search in the SEC’s Edgar database reveals that Warren Finance is not registered, suggesting illegal operations.

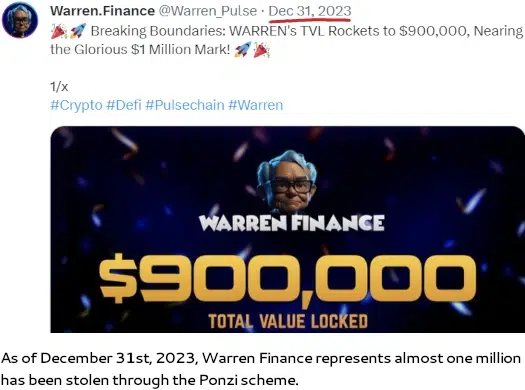

Ponzi Scheme Alert: The structure of Warren Finance aligns with that of a Ponzi scheme, where new investments are used to pay existing investors. As seen with similar schemes like Drip Network, Warren Finance employs the WARREN token, a PRC-20 token on PulseChain. The collapse of the scheme is inevitable, leaving investors with worthless tokens they cannot cash out.

Conclusion: Investors should exercise extreme caution when considering involvement with Warren Finance. The lack of transparency, questionable leadership, and potential legal issues indicate a high risk of financial loss. It is crucial to thoroughly research and seek professional advice before engaging with any investment opportunity to protect oneself from falling victim to fraudulent schemes.